To be honest, I have never thought much about insurance until I went overseas to study. Medical costs for a foreigner is ridiculously expensive, and immigration department made sure that all students coming in on a student visa had sufficient coverage tagged to them before approving of their visa.

Until I got to Perth, and for some reason, we decided to get Content Insurance for our house and personal effects. It was a godsend. Our stuff got stolen from our car when we were out for a pre-wedding photoshoot. Wedding jewellery, camera, wallets, sunglasses..shit loads of stuff that amounted up to almost AUD$11k. Crazy eh? But we got covered. All we needed to do was to pay for excess of about $100 and we got everything else back.

And then we got married, and had Oliver. In the midst of my pregnancy, Donald sussed out a financial advisor and we have not looked back since. We now have a plethora of policies that ensures that we are sufficiently covered; that will enable me to look after the kids without having to go back to work until they are way much older if Donald passes first. Morbid, but definitely something that new parents or parents-to-be will need to think about. It is not just about covering yourself. It is also about ensure that the people around you are taken care off financially.

Which brings me to the next point. Insurance is a good to have. But it can be costly. Our family’s policies equate up to over $10k in premiums annually. Crazy huh? On a single income family, it can make one feel a little nauseous at seeing that amount of money go out.

What parents-to-be and parents should know about your child’s Medisave account

I knew that QT has a Medisave account (sucks to be Ollie cos he was born before 26 Aug 2012). But I had totally NO CLUE as to how I could use it. As QT was born at 34 weeks, no one wanted to cover him until he was given an all clear. And then FHL, he had UTI at 6 weeks, and that of course made everything peachier and that kinda sealed his fate that he was definitely not gonna get covered until he was probably 2yo.

His 3-day “holiday” at KKH was then paid for with my Medisave and anything or everything after was paid for with his CDA account (hellooooo depleting funds). I mean..if I had known more about the MediShield Plan, I would have used it to pay for his hospital stay at KKH! So this is the low-down about it.

TIP: Use your child’s Medisave to pay for their own Shield Plan.

A CPF Medisave Account is created for newborns who are Singapore Citizens born on or after 26th August 2012 (click here for more info). These babies will receive a $3,000 grant in their Medisave account in 2 equal tranches; $1,500 after the registration of birth, and the other $1,500 will be deposited in the subsequent year if the child continues to be enrolled in MediShield or a Medisave-approved Integrated Shield Plan (e.g., NTUC Income’s Enhanced IncomeShield Plan).

Newborns born on or after 1st January 2015 will get an enhanced $4,000 Medisave Grant for Newborns.

The current MediShield Life offers simple coverage for everyone, at an affordable premium deductible from your CPF MediSave account. Some of us would then take on an Integrated Shield Plan (e.g., NTUC Income’s Enhanced IncomeShield Plan) to enhance the coverage, which can be funded fully/partially via our MediSave. To further reduce our cash payments in the event of a claim, we may even take on a Rider so that we would not need to pay the deductible or co-insurance portion of our medical bills.

Did you know that taking on that Integrated Shield Plan (ISP) doesn’t mean that you no longer have MediShield. Your ISP is on top of whatever coverage MediShield offers you. The premium for your MediShield is now included in whatever premiums that you are paying your private insurer. Your private insurer also makes it easier for you to make claims through them, instead of having it to claim from CPF & your private insurer. At the backend, your private insurer would settle the premiums and claims with CPF.

Everyone remains enrolled in MediShield unless you decide to opt out for it. So for our kids, even if we don’t do anything about it, we will get that second tranche of $1,500 in the following year.

So what does all these mean?

Assuming on the current MediShield Plan, premiums for kids aged 1-20yrs (age next birthday) is at $50 per annum. With a $3,000 child MediSave grant, it will be sufficient to fund premiums for the next 20 yrs and still end up with a balance of $2,000.

MediShield Life came into enforcement 1 November 2015 and it will provide better protection for life for all Singaporeans and Permanent Residents, including those who may already have a serious medical condition. Benefits will also be enhanced with higher claim limits and lower co-insurance rates.

See information here

Should I still need to get an ISP for my child?

Now you may start wondering if the MediShield Life coverage is sufficient and should an ISP enhancement be still necessary. In my personal opinion, it would still be good to do so because:

1) The benefits offered by MediShield Life is not as charged and has sub-category limits for both Inpatient and Outpatient treatments. The limits are good for government restructured hospitals (like SGH, CGH, KKH, etc), B2 wards and below, with subsidies. It is definitely not sufficient if I want to have the option to choose my own doctor/specialist for my child, or or have them be admitted to a private hospital / “A” classed ward in a government restructured hospital.

2) There is no option to purchase a rider for MediShield Life to cover the deductibles and co-insurances of the plan.

3) The MediShield Life plan annual limit is capped at $100,000.

See information here

What if you want to get an ISP?

Well, the agent I spoke to mentioned that annual premiums for children, who are Singapore Citizen, based on an “As Charged” Basic Plan (for restructured government hospitals for ward class B1 and below) are as follows:

Again, with the $3,000 child MediSave grant, you won’t need paying premiums for the next 20 yrs, and still have a balance of $972.

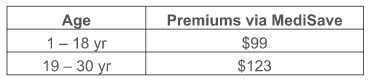

Then of course, there are parents who would also like to have more choices in terms of hospitals and doctors, they may wish to choose a “Preferred Plan” (For Standard room in a private hospital or private medical institution and below). Annual premiums for such plans will be as follows:

In this case, the child MediSave grant will still be able to fund your child’s annual premiums for at least 15 years! Thereafter, you can use your MediSave and take over funding your child’s plan until they decide that they are ready to pay the premiums themselves (my mom’s still paying some of mine!).

Disclaimer: This article is written based on the information provided on MediShield / MediShield Life at the linked websites and is subject to my understanding of what I have read. It is written also based on my own opinion and any information provided regarding the NTUC Enhanced IncomeShield plan is again subject to my understanding of it, and as explained based on my own experiences, which may or may not apply to the reader’s circumstances. Should you need further clarification on MediShield coverage and NTUC Enhanced IncomeShield plans, kindly contact NTUC Income directly.

stephenie

June 26, 2015 at 10:08 am

Many years ago i called up AiA n other conpanies regarding using my son medisave to buy insurance. Was rejected s they do not hav form to process.

So is it only ntuc hav such plans that can use my child medisave ?

enitsuj

June 26, 2015 at 10:13 am

Hi Stephenie, I would have thought it applies to all other insurers as well. As I only spoke to an NTUC agent cos of their promo, I am not sure about the other companies. The CPF MediShield website did say Integrated Shield Plans. If AIA and other companies are offering it, it should be payable with your child’s Medisave? You may wish to contact them again to see if it is possible.

Otherwise, the current NTUC plan is pretty good with the first year premium covered. You can contact the agent in the article to find out more. =)

stephenie

June 26, 2015 at 11:37 am

No, i asked many of the insurance companies n even govt bodies regarding using my son CPF ever since govt announced giving $3k.

So im surprised that now NTUC can.

Yes i wil check abt this cos my goal is to let my son fully covered without paying a single cent for hospital bill.

Diff company hav diff plan like coverage, exclusion, co-ductible n co- insurance… etc

Thk alot for sharing.

Remind me to check again.

Brenda

June 26, 2015 at 3:14 pm

Hi Stephanie,

Do consider on comparing the benefits that different companies offer.

Janice

July 6, 2015 at 10:44 am

Hi Stephanie,

As this is new to me as a new parent, would like to find out more if this coverage includes Prudential? When checked with the agent, they do not seems to be sure of it.

enitsuj

July 6, 2015 at 12:02 pm

Hey Janice,

According to CPF website, as long as it is an integrated shield plan by the private insurer, you can use your child’s Medisave to pay for it. Do if Prudential has a shield plan for kids, it will be covered. How old is your child? Bear in mind only children born after 26 Aug 2012 will have a MediSave account. You will also need a letter from the CPF stating that the account has been opened (mine came 2 mths after kiddo was born.) If you are open, you can give the NTUC agent a call to compare plans and see if it is smthg you can consider. Sorry, I mean if your agent is not sure, you might as well ask an agent who knows his stuff. Hope the info helps!

-justine

Joyce

May 12, 2016 at 5:12 pm

if u can afford to use ur own medisave to pay for ur kids premium, u can leave the $3k in their account. With compounding interest, it will be more than 40K when ur kids reach 65 yrs old… help them in their retirement plan abit 🙂

To Joyce

April 26, 2017 at 11:12 pm

No need to joke here. Everybody knows money in CPF is funny money. Can see but cannot touch.